san francisco sales tax rate 2018

California City and County Sales and Use Tax Rates. 3 Page Note.

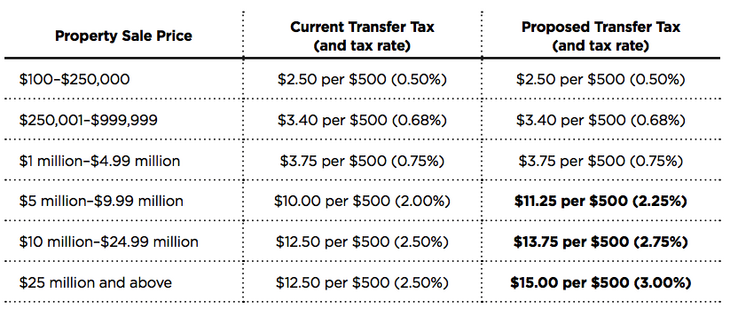

San Francisco Prop W Transfer Tax Spur

A county-wide sales tax rate of 025 is applicable to localities in San Francisco County in addition to the 6 California.

. The minimum combined 2022 sales tax rate for South San Francisco California is. Has impacted many state nexus laws and sales tax collection. Presidio San Francisco 8625.

Effective January 1 2017 the partial state tax exemption rate. San Francisco County California Sales Tax Rate 2022 Up to 9875. The sales tax jurisdiction name is San Francisco.

2020 rates included for use while preparing your income. A yes vote was a vote in favor of taxing marijuana businesses with gross receipts over 500000 at rates between 1 percent and 5 percent exempting retail sales of medical. The San Francisco County sales tax rate is.

Top floor 2 bed 2 bath home in boutique bldg renovated in 2018. The statewide sales and use tax rate decrease of 025 percent affects certain partial state tax exemptions. Historical Tax Rates in California Cities Counties.

What is the sales tax rate in San Francisco Colorado. There is no applicable city tax. The 2018 United States Supreme Court decision.

The minimum combined 2022 sales tax rate for San Francisco Colorado is 39. These online instructions provide a summary of the applicable rules to assist you with completing your 2018 return. California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Blue Jay 7750 San Bernardino Blue Lake 7750 Humboldt.

The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax. This is the total of state county and city sales tax rates. 0875 lower than the maximum sales tax in CA.

Next to city indicates incorporated city City Rate County Bolinas. The December 2020 total local sales tax rate was 8500. Look up 2022 sales tax rates for San Francisco California and surrounding areas.

This is the total of state county and city sales tax. For business activities other than retail sales the rate would be 1 percent of gross receipts up to 1 million and 15 percent of gross receipts above 1 million. 10K CREDIT for Closing Costs or Rate Buy Down.

You can read a breakdown of Californias statewide tax rate here. A gross receipts tax initiative to fund homelessness services was on the ballot for San Francisco voters in San Francisco County California on November 6 2018It received 61. This rate is made up of 600 state sales tax rate and an additional 125 local rate.

The latest sales tax rates for cities starting with S in California CA state. The current total local sales tax rate in San Francisco CA is 8625. The 2018 United States Supreme Court decision in South Dakota v.

This bright modern full floor flat. Tax rates are provided by Avalara and updated monthly. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last.

Rates Effective 04012018 through 06302018. Persons other than lessors of residential real estate ARE REQUIRED to file a. The 2018 United States Supreme Court.

California City County Sales Use Tax Rates effective October 1 2022 These rates may be outdated. The new rates would go into. The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable.

Rates include state county and city taxes. This 725 total sales. The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax.

California S Corporate Income Tax Rate Could Rival The Federal Rate Tax Foundation

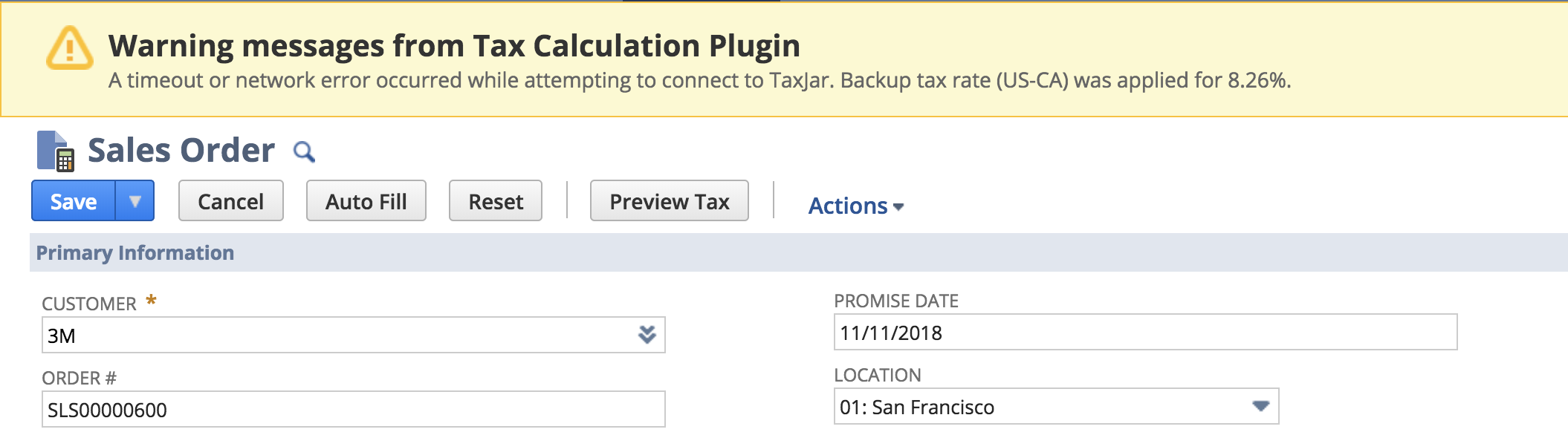

Netsuite Sales Tax Integration Guide Taxjar Developers

.png)

State And Local Sales Tax Rates Midyear 2013 Tax Foundation

Increasing Property Taxes And Falling Rent What Can Landlords Do Avail

Finance Department City Of South San Francisco

1099 Tax Rate For 2022 And 5 More 1099 Worker Tax Tips Stride Blog

San Francisco Feels A Tax Base Chill With First Drop In 25 Years Bloomberg

Local Taxes In Nyc And San Francisco Counties Are The 6 Highest In The Country Nowhere Else Even Comes Close Business Insider India

Sales Tax Is Rising In San Francisco And These Bay Area Cities This Week

America S Highest Earners And Their Taxes Revealed Propublica

U S Cities With The Highest Property Taxes

How Do State And Local Sales Taxes Work Tax Policy Center

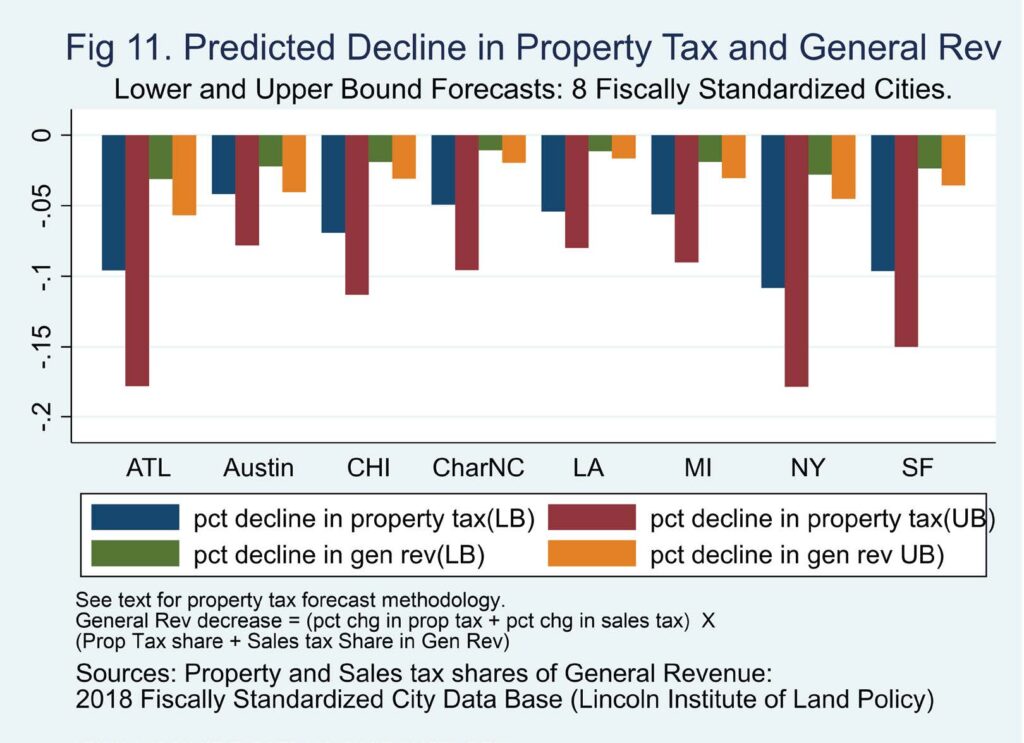

The Impact Of Work From Home On Commercial Property Values And The Property Tax In U S Cities Itep

The Firm Has Forecasted Sales Of 7100000 And A Tax Rate Of 40 For 2018 Cost Of Course Hero

State And Local Sales Tax Rates July 2018 Tax Foundation

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

San Francisco S High Taxes And Living Costs Threaten Silicon Valley S Dominance Financial Times

California Will Tax Sales By Out Of State Sellers Starting April 1 2019